Montgomery Transport Group provides a wide range of customs services to its broader customer base.

With a team of in-house experts on hand to explain and de-mystify the often-complex world of customs regulations you can rest assured that, whatever your needs, we are on hand to offer guidance and support throughout the process.

Below are some of the more common areas we are often asked about, to help you understand the processes and regulatory compliance.

EORI or Economic Operators Registration and Identification number is a registration for parties who trade internationally and exchange information with Customs authorities EORI numbers identify who the importer of record and who exporter of record is for each declaration.

It is advisable to include EORI numbers of buyers and sellers on all Commercial Invoices to assist in movement of goods across International Frontiers.

Where EORI numbers identify companies, commodity codes are used to identify products to customs and other regulatory authorities.

An import commodity code is a 10 digit number and stems from agreements by WTO members. Some commodities require additional 4 digits TARIC codes e.g. Measuring Codes or Anti-Dumping duty codes.

While EU & UK export commodity codes are only required to 8 digits it is recommended to provide 10 digits, particularly for use in EU imports.

Commodity codes can also be referred to as:

It is the responsibility of the Importer of Record on a Customs Import Declaration to provide the correct codes.

NB: For DDP the Importer of Record is the Seller!

For an Export Declaration; the responsibility is normally with the seller but depends on Incoterms and other Contractual Agreements.

Commodity codes primarily ensure declaration of the correct goods and products which means:

In Preparation start by identifying the correct commodity codes for every one of your products.

Finding the right code isn’t always easy. Always ask for advice on classifying your goods if you are unsure:-

Ask HMRC for help classifying your goods

https://www.gov.uk/guidance/ask-hmrc-for-advice-on-classifying-your-goods

Once you have your commodity codes you should determine the level of VAT and if any import or export licences are required. As an example, most milk is VAT free but if you process it into ice cream it is subject to VAT because it is classed as a luxury item. However, there are exceptions to this rule, so always check and do not assume.

Please seek the correct information on this. You can use these websites to find out if you require a licence:

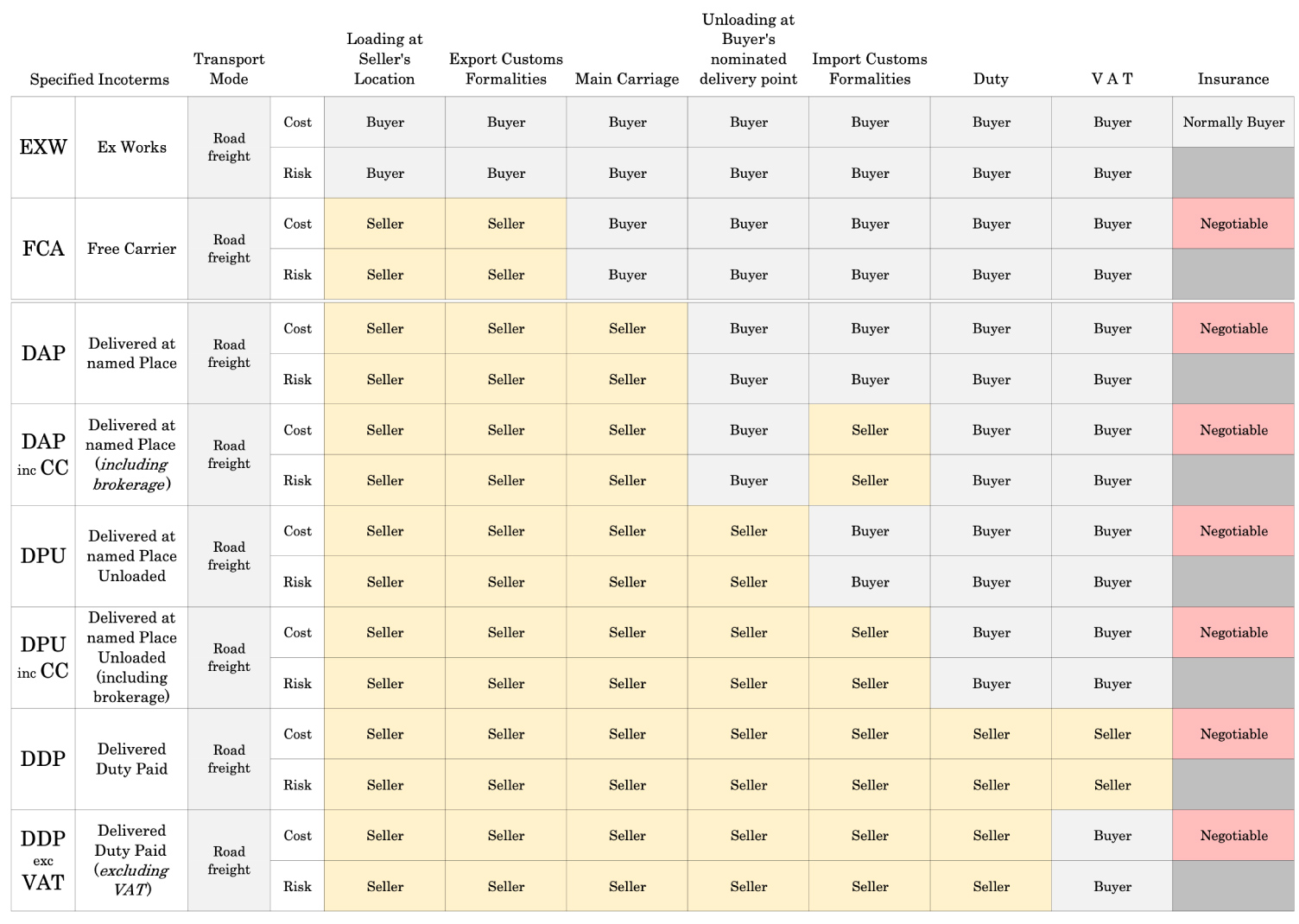

Incoterms® are normally recorded on a Contract of Sale but to necessitate International Transport, they should also be stated on all Commercial Invoices pertaining to all Consignments.

In some agreements, contractual parties have added cavets to Incoterms® to assist in the movement of goods through borders.

(Only if specified in Sales Contract)

A commercial Invoice contains pertinent information about goods in Carriage and acts as a Bill of Sale between a Buyer and Seller.

It should include:

Paying attention to detail while setting up a Commercial Invoice system will be rewarded. Your invoice must be prepared exactly as you and your customer agree, and as per the proforma invoice if one has been produced. This includes intricate details e.g. whether you should prepare the commercial invoice on your company letterhead or not.

A proforma invoice is usually one generated when for example an order is transmitted to a supplier. A Commercial Invoice will detail the goods after they are prepared for transport, and that will omit things like parts that have failed quality control. It is a pre-advice document which serves as an Instruction for Action, it can be used to define information, to initiate the Negotiation Process and it outlines the expectations for an Export Sale. This widely recognised document can serve as a quotation and can contain a validity period as well as estimated transport costs. It can easily be converted to a Commercial Invoice and can be used by banks where they are acting as an Intermediary.

If you would like to find out any information, give us a call on 02890 849321

Montgomery Transport all rights reserved